Orange County Syndrome

How the birthplace of subprime mortgages paved the way for Trump's rise.

There is no President Trump without Orange County, California. This is an argument I’ve been pondering lately. Like everyone, I have been trying to make sense of what is happening to American society. And I keep coming back to my hometown. This may be because I’m inclined to view events through the lens of financial crime. It probably also has to do with the fact that I’m about to become a father, something that makes you reflect on your own upbringing. But there’s truth to it. In fact, I think you can view the last 20 years — a cycle of crime, rage, and populism — as an inadvertent response to a series of events that happened in the O.C.1

I call it Orange County Syndrome.

It is important to note that Orange County Syndrome is not an indictment of the place itself. Sure, towns like Newport Beach are detached from reality, places where aging Reaganites shank golf balls and complain about their taxes. And yes, Orange County is the Vatican of facelifts. The Rome of rhinoplasty. But it is also filled with good people doing good things. Most of whom are busy taking their kids to Junior Lifeguards and getting a sprinkled frozen banana on Balboa Island. I’ll always have a soft spot for my hometown (something a Newport plastic surgeon could probably fix).

Nor could Orange County do this alone. As we will see, the financial virus it birthed found in the rest of American society a more than willing host. And it was the failure of U.S. policymakers to address the initial infection that allowed it to mutate into a populist political movement. One that was inspired by disgust with financial crimes, only to usher in even greater financial crimes.

But there is no denying the facts. Orange County was ground zero, setting off a chain of events that has led to a crisis in American democracy and the greatest challenge to the international system since World War II. This seems unlikely. But if you look past the miniature poodles and peer through the palm trees, you’ll notice Orange County is not just a bunch of beautiful beaches. It also has offices. And in those offices was born a fateful phrase: subprime mortgage-backed securities.

Stage 1: Incubation

“Orange County,” President Ronald Reagan remarked in 1988, “is where the good Republicans go before they die.”2 And, indeed, it has long been the center of political conservatism and pro-business thinking in California. It is home to the Richard Nixon Presidential Library and Museum. Nixon himself retired to his “Casa Pacifica” mansion in San Clemente, sometimes referred to as the Western White House. There are other subtle references. The airport is named after John Wayne, an actor and conservative icon who helped enforce Joseph McCarthy’s “Black list” by denying opportunities to suspected Communist sympathizers.3

Not everyone is a Republican; Laguna Beach has long been a socially liberal sanctuary popular with the LGBT community.4 But the conservative impulse is deep-rooted. Lisa McGirr has written an entire history of Orange County as the birthplace of the American right, delightfully titled Suburban Warriors.5 In the early 20th century, it was a sleepy town home to ranchers, farmers, and “Cowboy capitalists” sharing a belief in individualism and strict religious moralism.6 This could lead to extreme outcomes, such as electing Ku Klux Klan supporters to local positions in Anaheim.7

But the more lasting effect was a home-grown conservatism shared by the county’s largely homogenous and increasingly affluent population.8 As McGirr documents, this became entrenched in the 1960s, as organizations such as the Orange County School of Anti-Communism (headed by Walter Knott, owner of much-loved amusement park Knott’s Berry Farm) railed against the dangers of socialism.

Crucial to this movement was a type of free-market libertarianism strongly supported by Orange County’s business community. McGirr notes that this went beyond a mere opposition to communist ideology:

This variant was a broad rubric that encompassed not simply a rejection of a Soviet-style organization of society but also a rejection of “collectivism” in all its forms, including federal regulations, the welfare state, and liberal political culture. In Orange County, “anticommunism” often meant opposition to the United Nations, agricultural controls by the federal government, or any sort of planning.9

This never went away. And thus it is no surprise that Orange County soon became a regional hub for financial services. PIMCO, one of the world’s largest asset managers, is headquartered in Newport Beach. So too is Pacific Life, a giant insurance company, alongside various banks and tax planners. But the county’s real financial innovation originated in another corner of the financial world. One that would ignite a vicious cycle of events: the securitization of subprime lending.

Stage 2: Infection

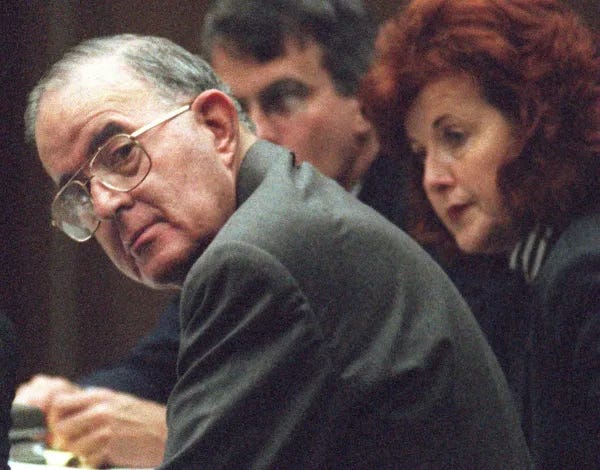

Orange County has quite a history with financial derivatives. In the 1990s, the County Treasurer, Robert Citron, undertook a series of risky financial bets that would plunge the municipality into bankruptcy.10 Part of the problem was that Citron, a former car salesman, had no training in accounting (he apparently consulted astrologers on the movement of markets).11 Another contributor was Proposition 13, which restricted California municipalities from raising property taxes.

To compensate for lost tax revenue, Citron effectively transformed Orange County’s municipal finances into a hedge fund. By 1994, he had $7.6 billion in an investment pool, including voluntary contributions from local schools swayed by his promises of abnormal returns.12 Citron then borrowed another $13 billion, investing the whole pool into high-risk derivative contracts. This worked for a while. So much so that local politicians could look past his liberal leanings. “It doesn’t bother me that he is a Democrat,” proclaimed the County’s Republican Chairman of the Board, ”this is a person who has gotten us millions of dollars. I don’t know how in the hell he does it, but he makes us all look good.”13

Until he didn’t. Interest rate movements wiped out the fund in 1994, leading to $1.64 billion in losses.14 Orange County became the largest municipality in U.S. history to declare bankruptcy, imperiling pension plans and public projects.15 Citron was eager to shift the blame to the municipality’s bankers, complaining in court-released phone transcripts that “nobody at Merrill Lynch ever came to me and said, ‘You know, you shouldn’t be buying so many of these things.’”16 But public prosecutors were not convinced. Facing 14 years in prison, he pled guilty to misleading municipal bond investors in return for a heavily reduced sentence.

While Citron was betting on derivatives, O.C. companies were engaging in their own financial experiments. In the 1990s, firms like Long Beach Savings F.S.B. were inventing a whole new class of investments: subprime mortgage-backed securities. In simplified terms, this is all about reselling mortgages. Lenders can sell these mortgages (that is, transfer their entitlement to repayment) to third-parties, who then repackage lots of mortgages together into complex investment products. One problem with this is that it creates ticking time bombs of risk in the system. Another is that it incentivizes “sub-prime” lending to unqualified borrowers.

This is bad enough when sold to private investors. But what investment firms like Long Beach Savings pioneered was their sale as securities products available to Wall Street financial institutions.17 This exponentially enhanced the amount of money that could be invested into these products. By 2008, eight of the nation’s 12 largest subprime lenders were based in Orange County.18 And because these firms could immediately sell off their mortgages, they had an incentive to lend freely regardless of whether customers could really afford a home (or, perhaps, a second home):19

“If they have a house, if the owner has a pulse, we’ll give them a loan.”

- Russell Jedinak (1991), subprime specialist and owner of Orange County-based Guardian Savings & Loan

Roland Arnall, billionaire founder of Orange County’s Ameriquest, was the “godfather” of this subprime lending innovation.20 Employees described it as a “boiler room”-like atmosphere, in which they were encouraged to falsify appraisals to qualify borrowers for mortgages they couldn’t actually afford.21 Ameriquest later paid $325 million to 49 state attorneys general to settle charges of consumer harm.22 But this didn’t stop President George W. Bush from nominating Arnall — a major Republican donor — to serve as Ambassador to the Netherlands.23

You know the rest of the story. These lending and securitization practices would spark the 2008 financial crisis. But O.C. firms couldn’t do this alone. Equally responsible were Wall Street banks, credit-rating agencies, and a culture that encouraged Americans to take on excessive debt. Like Covid, Orange County Syndrome spread throughout the nation, infecting the entire financial system. And policymakers’ failure to punish those involved would allow it to mutate into something much worse.

Stage 3: Mutation

There is no global financial crisis without Orange County, California. And without the financial crisis, there is no President Trump. Voters, many of whom lost their homes in the chaos, were enraged that not a single major executive was criminally prosecuted for their (in)actions.24 And while compensation packages often feature complex legal precommitments, it added insult to injury for many Americans that Wall Street dished out more than $18 billion of bonuses in 2008.25

But don’t take my word for it. Ask Steve Bannon. In a recent interview with Michael Lewis, Trump’s former White House Chief Strategist confirmed that the financial crisis was crucial to his political rise:

Lewis: Do you think [Trump’s] rise was directly a result of the anger that was generated by the financial crisis?

Bannon: 1,000 million percent…What the financial crisis did is I think brought to the forefront the corruption of the neoliberal-neocon-neoconservative model. It just doesn’t work. The American people are not dumb. Eventually they will think it through and go, ‘Hey, I’m getting fucked’…Their tax money went to the bailout and we got what 8% back in interest is bullshit. So no, with no financial collapse you do not [get Trump].

The post-2008 populist movement was, in other words, directly inspired by frustration with financial crimes perpetrated in the housing market. The solution? The election of a convicted felon. By March 2024, Trump had been charged with 88 criminal offenses in four separate criminal cases.26 And Trump seems intent on earning the moniker of the most corrupt president in U.S. history.

Prior to his inauguration, Trump and the First Lady released personal meme coins that can be easily exploited for bribery.27 And it was recently reported by The Wall Street Journal that the U.A.E. invested $500 million into World Liberty Financial, a crypto start-up owned by the Trump family.28 It is surely a coincidence that Trump later approved the sale of advanced AI chips to the U.A.E.29 Trump has also suspended enforcement of the Foreign Corrupt Practices Act, or FCPA, a powerful law that prohibits American companies from paying bribes abroad.30

But Trump’s criminal past was of no concern to Orange County residents attending his 2024 fundraising event in Newport Beach.31 The extravagant luncheon, hosted by the billionaire founder of Oculus, took place at one of Newport’s most famous bayfront mansions. Hundreds of diehard fans lined Pacific Coast Highway. Meanwhile, yachts adorned with MAGA flags — and at least one boat advertising the QAnon conspiracy theory — surrounded the home in celebration.

It was a true full-circle moment. In the 1990s, Orange County introduced the world to a new financial innovation: subprime mortgage-backed securities. And those securities triggered an economic crisis, creating a wave of populist rage that powered Trump’s improbable path to the White House. So it was only appropriate that he return to the source of his success. Orange County, my hometown. A sun-soaked bastion of free market principles. That place where good Republicans go to die.

I’d like to state for the record that people from Orange County generally don’t use the term, “the O.C.” But it’s useful when writing.

Here’s a very-1980s headline fron the L.A. Times that probably wouldn’t fly nowadays: 18% to 30% of Population: Laguna Beach Grows as a Haven for Gays.

Ibid.

Ibid.

Ibid.

Ibid (p. 35).

Ibid.

Ibid.

Ibid. Also see Sex, Drugs, and the Subprime Meltdown.

The lone minor exception (which provided no satisfaction to most Americans) being Kareem Serageldin.

The Bannon quote nails it but misses the darkest irony: populist rage against unpunished financial crime led directly to electing someone who'd expand corruption exponentially. Studied the lack of prosecutions post-2008 and the anger was absolutely justified, but chanelling that into a movement that suspended FCPA enforcement is tragic. The cycle just accelerates.